Accident Benefits in Ontario

Accident benefits are an extremely important section of your car insurance policy! This often-overlooked component of your auto insurance policy offers vital support—covering medical expenses, rehabilitation, and even attendant care—regardless of who’s at fault.

Government Changes to Accident Benefits Coverage

In 2016, the Ontario government made significant changes to the auto insurance landscape, aiming to lower premiums for drivers. However, this reform also led to a reduction in standard coverage limits, leaving many drivers unaware of their options for increased protection.

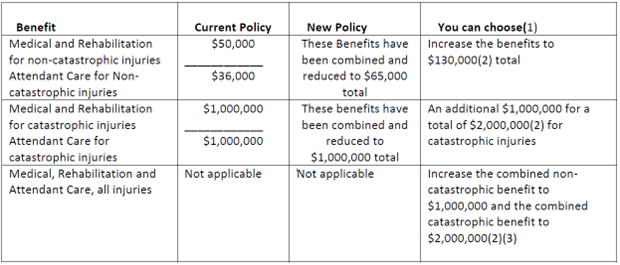

The most significant changes made to your policy are:

Let’s dive into why accident benefits should be at the top of your insurance priorities and how you can ensure you’re adequately covered.

Understanding Accident Benefits Coverage

Accident benefits are not just a checkbox on your insurance policy; they are a lifeline in times of crisis. If you’re injured in an auto accident—whether as a driver, passenger, or even a pedestrian—this coverage kicks in to help you manage the financial burdens of recovery.

Here’s a quick breakdown of the injury classifications and their corresponding coverage limits:

- Minor Injury: Up to $3,500

- Non-Catastrophic Injury: Up to $65,000

- Catastrophic Injury: Up to $1,000,000 (can be increased to $3,000,000 with optional coverage)

We often tell our clients: you might not think you need these higher limits–and I hope you never do–but accidents happen, and having a robust safety net can make all the difference in your recovery journey.

Key Accident Benefits Options

- Increased Income Replacement

The standard level of income replacement provided in the policy ($400 per week maximum) can be increased by purchasing optional coverage so that the weekly limit is up to $600, $800 or $1,000. All income replacement benefits are based on 70% of your gross weekly income. - Increased Medical, Rehabilitation and Attendant Care

The standard benefit pays up to $65,000 for medical, rehabilitation and attendant care expenses with a 5 year time limit except for children for non-catastrophic injuries. - You can purchase the optional increased medical, rehabilitation and attendant care benefit of $130,000; or an optional increased medical, rehabilitation and attendant care benefit of $1,000,000 for non-catastrophic injuries.

- Increased Medical, Rehabilitation and Attendant Care

If catastrophically impaired, the standard benefit pays up to $1,000,000 for medical, rehabilitation and attendant care expenses. You can purchase to increase the catastrophic benefit to a total of $2,000,000.- If you purchase both the additional Medical, Rehabilitation and Attendant Care benefit for catastrophic injuries and for all injuries, the total eligible benefit amount for a catastrophic impairment would be $3,000,000.

- Caregiver, Housekeeping and Home Maintenance Expense

The standard caregiver, housekeeping and home maintenance expenses benefit is available only for a person who is catastrophically impaired up to $100/week. You can purchase an optional benefit to provide this coverage for all impairments. - Dependent Care

There is no standard dependent care benefit for persons who are employed and care for dependents. You can purchase an optional benefit to receive additional weekly dependent care expenses of $75 for the first dependent, and $25 for each additional dependent, up to $150 per week. - Increased Death and Funeral

The standard level of death benefits paid to the surviving spouse and dependent of a person who is killed ($25,000 to surviving spouse; $10,000 to each surviving dependent) can be doubled by purchasing this optional coverage. This coverage also increases the standard funeral expense benefit from $6,000 to $8,000. - Indexation Benefit

This optional coverage will ensure that certain weekly benefit payment and monetary limits will increase on an annual basis to reflect changes in the cost of living. - Added Coverage to Offset Tort Deductible – OPCF48

This endorsement will provide a $10,000 buy down on the deductible currently imposed by the Insurance Act of $36,905.40 on any settlements you should be awarded for pain and suffering following an automobile accident.

Take Action: Review Your Coverage Today

It’s time to take a proactive approach to your insurance. We encourage you to review your existing policy and identify any gaps in your accident benefits coverage. If you find that you’re not fully protected, don’t hesitate to reach out! Whether by phone or email, we are here to provide tailored pricing options that suit your needs.

In a world where accidents are unpredictable, ensuring that you have comprehensive accident benefits coverage is essential. Protect yourself and your loved ones by understanding and maximizing this critical part of your auto insurance policy. After all, being prepared is the best way to face the unexpected!