Vehicle theft is a growing concern in Ontario, and insurance companies are responding with new surcharges for high-risk vehicles. In 2022, Canadian insurers paid out a staggering $1.2 billion on car theft claims, with Ontario experiencing a 48% increase in thefts. This rise not only affects those who lose their vehicles but also impacts communities and insurance rates. Understanding these trends can help vehicle owners protect themselves and their wallets.

Understanding High Theft Vehicles

In order to combat this increased risk, Insurance companies are now implementing surcharges starting at $500 for vehicles deemed high risk for theft. Research shows that SUVs and newer vehicles are often the most targeted. To stay informed, it’s essential to check resources that list high-risk vehicles. However, the best approach is to contact us before purchasing a new vehicle, as different insurers may classify vehicles differently.

How to Reduce Your Risk of Theft

As a vehicle owner, there are several proactive steps you can take to minimize the risk of theft:

1. Install an Anti-Theft Device

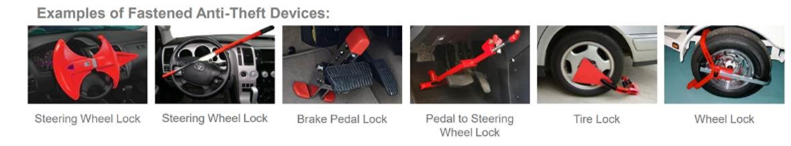

Investing in an anti-theft device can significantly deter thieves. These devices are typically affordable and provide peace of mind. Common options include:

- Steering wheel locks

- Wheel locks

- Brake Pedal Locks

- Pedal to Steering Wheel Lock

- Tire Locks

- Alarm systems

If you install one of these devices, let us know! Depending on your insurance provider’s rules, you may qualify for an anti-theft discount on your policy.

2. Consider Tracking Systems

If your vehicle is classified as high risk for theft, your insurance company will notify you during policy renewal or upon purchasing a new vehicle. Installing top-of-the-line tracking and recovery systems can eliminate the theft surcharge. Many of these systems feature visible logos or etchings, acting as a significant deterrent to potential thieves.

What to Do If Your Car Is Stolen

While we sincerely hope you never face this situation, knowing the steps to take can make a difference:

- Report the Theft: Call the police immediately and provide as much information about your vehicle as possible.

- Secure Your Documentation: If the ownership documents are in the vehicle, replace them with a printed copy until you can safely store the originals.

- Contact Your Insurer: If you have comprehensive coverage (included in All Perils Coverage), you can file a claim without negatively impacting your rates. Have your policy number handy and call your insurer’s claims service.

If you don’t have your policy number or have questions about your coverage, don’t hesitate to reach out to us!

Final Thoughts

Protecting your vehicle from theft is more important than ever. By being proactive and informed, you can reduce your risk and potentially save on insurance costs. For personalized advice and assistance, feel free to contact us!